how are annuities taxed to beneficiaries

Taxes on Inherited Annuities. Taxes and Annuity Payouts.

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

When an annuity payment is made 50 of each payment would be income taxable.

. With regard to inherited annuities and this is good for both purchases and beneficiaries to understand the same general rules are applicable. Annuities are insurance contracts that offer unique guarantees and tax deferral and they are commonly used to save for retirement. FindInfoOnline Can Help You Find Multiples Results Within Seconds.

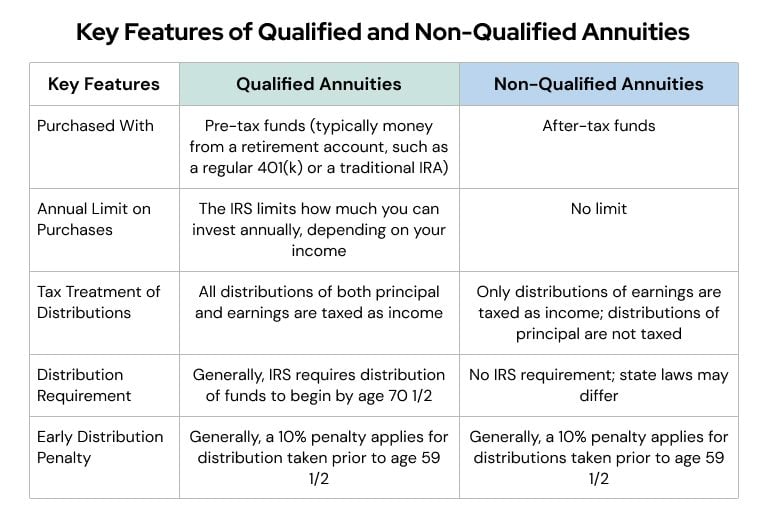

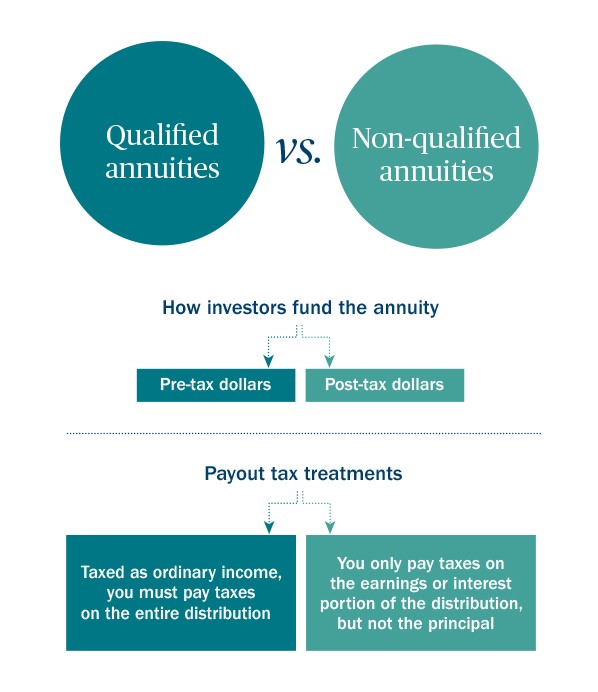

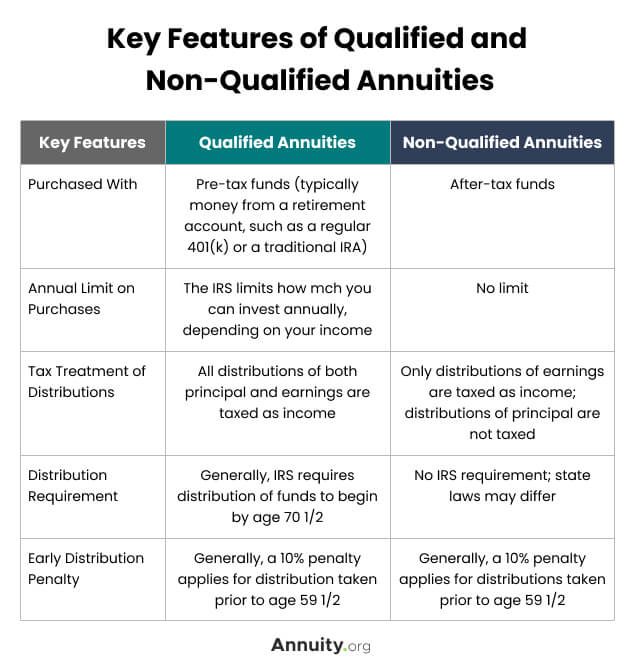

Ad Learn More about How Annuities Work from Fidelity. Tax Consequences of Inherited Annuities. Based on whether you purchased the annuity with qualified pre-tax or nonqualified post-tax.

If you have an annuity contract you can choose a beneficiary to receive the remaining payments or. But this is not the case when inheriting an. Taxes at Death.

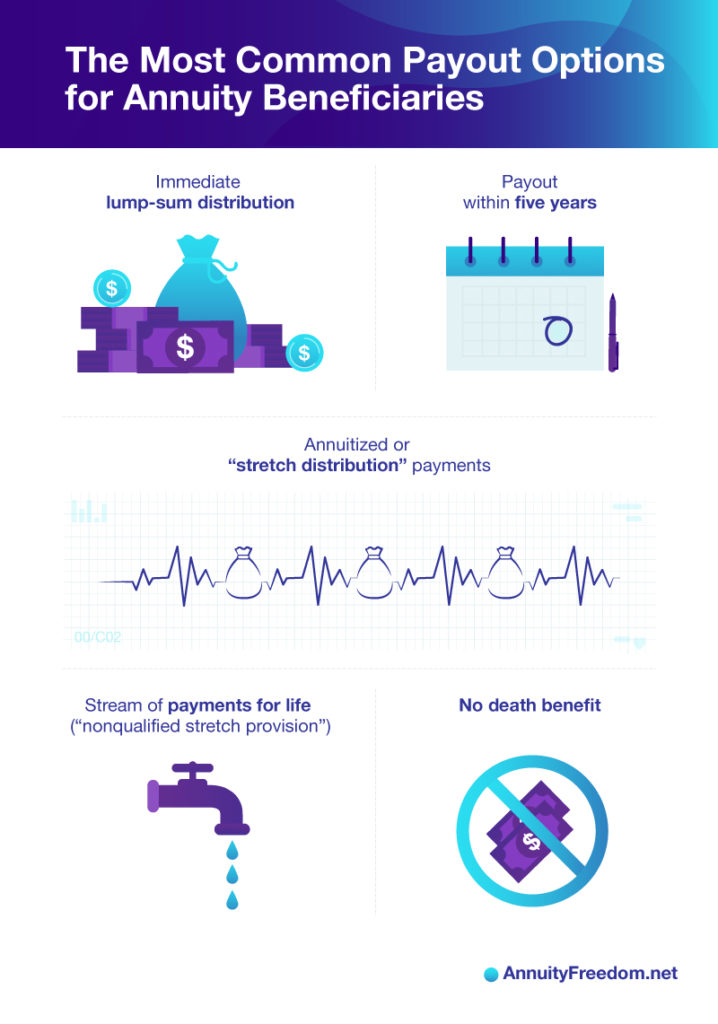

For example if the owner. For non-spouse beneficiaries of qualified annuities taxes depend on the payout structure that the beneficiary selects. When an individual inherits a life insurance policys death benefit they typically will not have to pay any income taxes.

Depending on. Different tax consequences exist for spouse versus non-spouse beneficiaries. Beneficiaries of Period-Certain Life Annuities.

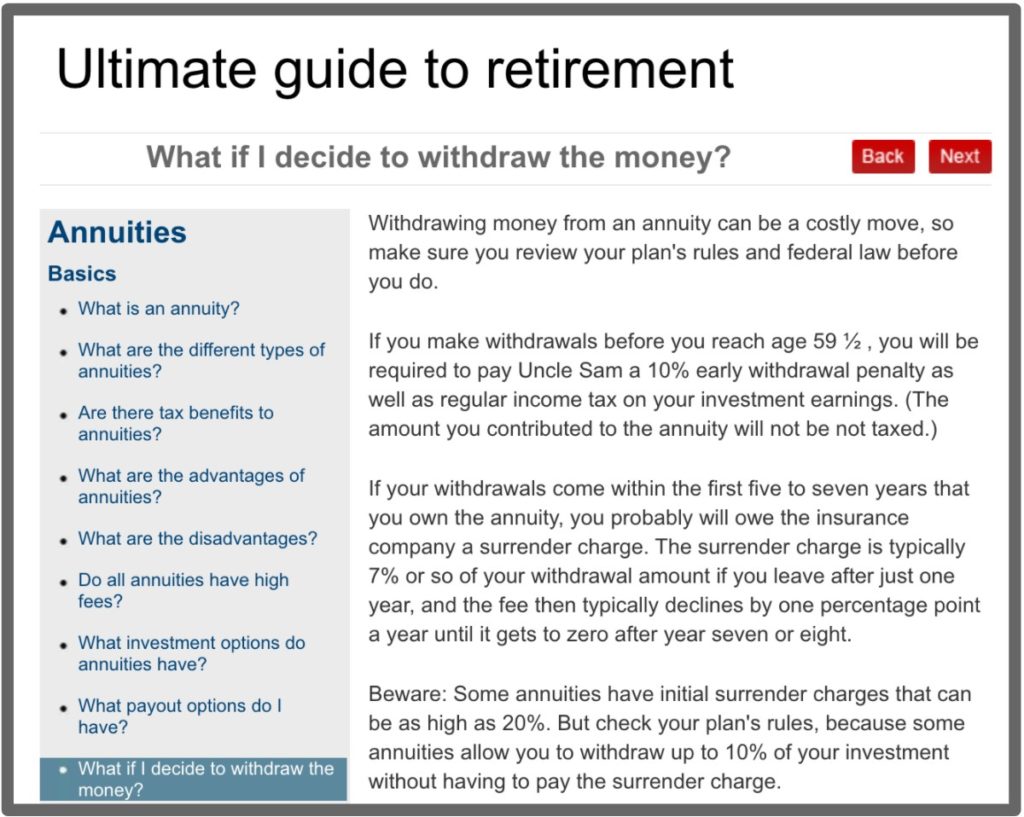

If the beneficiary selects a lump sum payment they must pay taxes. Your beneficiaries have a few options for dealing with the inherited annuity -- and the tax bill it triggers. Until you receive your annuity distributions or stream of income taxes are deferred.

Annuities are designed to build wealth and income for your retirement through tax deferral. These payments are not tax-free however. If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies.

Browse Get Results Instantly. A non-qualified annuity is you purchased with money you have already paid taxes on. Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both.

Interest earned in a deferred annuity the most popular type is not taxed until. Ad Search For Info About Are inherited annuities taxable. If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Surviving spouses can change the original contract. How Inherited Annuities Are Taxed. In particular most annuities have a death benefit and understanding how that death benefit will get taxed to the beneficiary who receives it is an important part of deciding.

This guide will explain how annuities work for beneficiaries when an annuity owner dies. If the beneficiary is entitled to receive a survivor annuity on the death of an employee the beneficiary can exclude part of each annuity payment as a tax-free recovery of. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments.

It depends on your contributions. The simplest option is to take the entire amount as a lump sum. The variable annuity contract may provide that at your death a person you name as a beneficiary will receive a lump-sum death benefit.

So if you wrote a check from your taxable bank or brokerage account to pay the premium. Ad Learn some startling facts about this often complex investment product. Ad Learn More about How Annuities Work from Fidelity.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities.

Annuity Beneficiaries Inherited Annuities Death

Required Minimum Distributions Required Minimum Distribution Life Insurance Quotes Life Insurance Premium

Annuity Beneficiaries Inheriting An Annuity After Death

Annuities In South Africa Living Annuity Vs Life Annuity Annuity Investing For Retirement Annuity Retirement

Annuity Taxation How Various Annuities Are Taxed

Beneficiaries Pay No Taxes On Non Registered Annuities Annuity Quotes Annuity Life Insurance Quotes

Living Abroad What About My South African Family Trust Family Trust South African South

Annuity Exclusion Ratio What It Is And How It Works

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Keyman Insurance Life Insurance Marketing Ideas Life Insurance Marketing Life Insurance Corporation

Taxation Of Annuities Ameriprise Financial

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Taxation How Various Annuities Are Taxed

Inherited Annuity Tax Guide For Beneficiaries

Annuity Beneficiaries Inheriting An Annuity After Death

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Qualified Vs Non Qualified Annuities Taxation And Distribution